Get

Get

Indian Rupees Fast!

- Free home delivery over £750

- with Royal Mail Special Delivery 1pm

- Better rates than the banks

“Easy process from start to finish. Competitive prices and excellent customer support. Would highly recommend and will use again.”

Emma Thompson

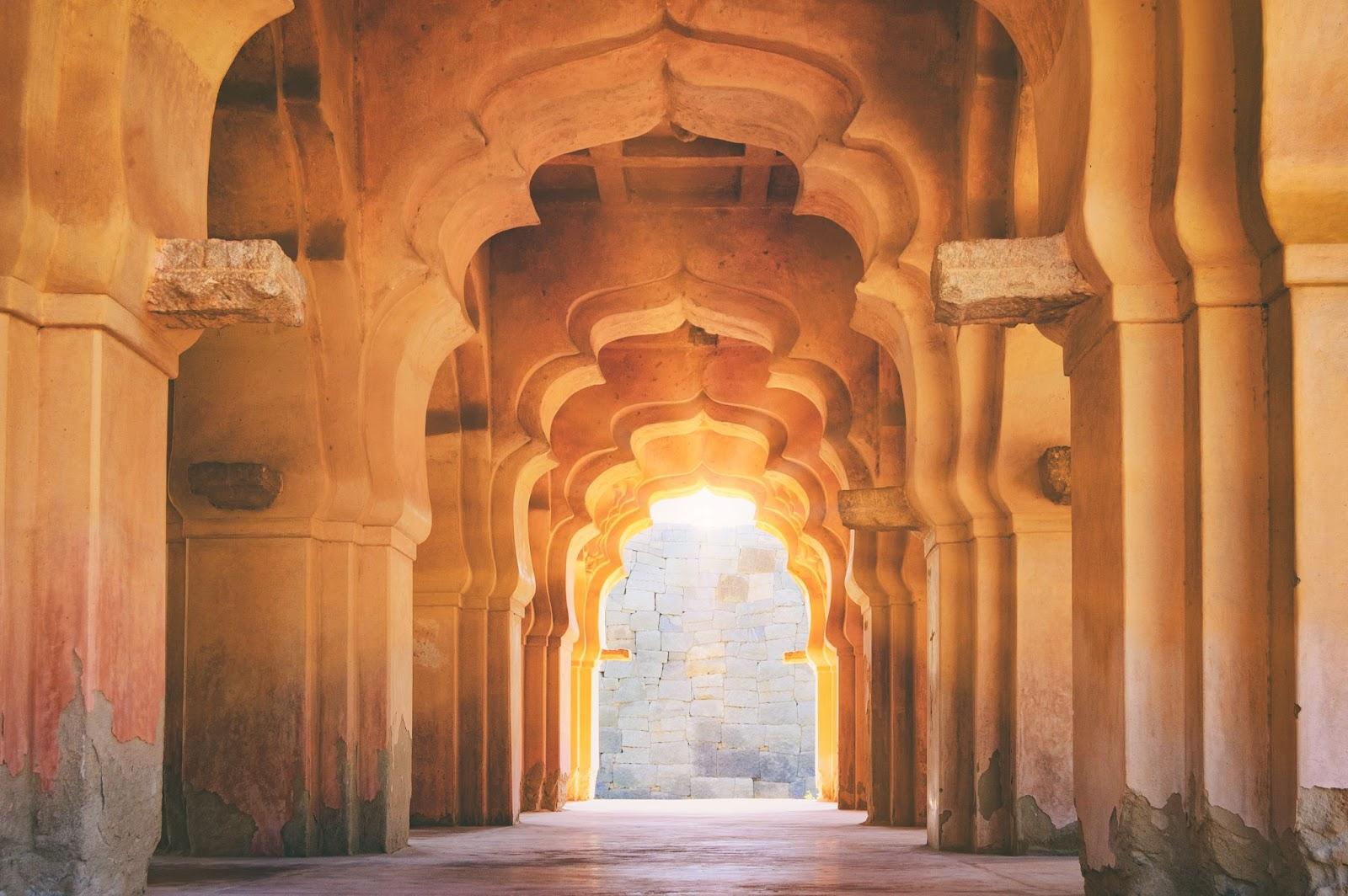

Travelling to India?

Get the best currency exchange rates for Indian rupees online

Prepare for your Indian adventure with Manor FX. Get the best GBP to Indian rupee exchange rates online, giving you more Indian rupees for your fantastic trip.

You can opt for secure delivery to your home or workplace or collect your travel money from our bureau near Heathrow.

Our quick, convenient online ordering system simplifies getting your Indian currency. Convert pounds to Indian rupees with Manor FX.

What is the official currency of India?

The official currency of India is the Indian rupee. The word “rupee” is derived from the Sanskrit word “rūpya,” meaning silver, reflecting the historical use of silver coins.

The currency symbol and rupee sign is ₹, and its international currency code is INR.

The rupee, managed by the Reserve Bank of India, has a rich history dating back to the 16th century. Today, the Indian rupee is one of the most widely used currencies in the world.

Getting the best exchange rates when exchanging British pounds will ensure you have more money to enjoy your trip.

We offer the best GBP to Indian rupee exchange rates. Check our rates and convert British pound to Indian rupee currency today!

Avoid hidden fees and excessive airport exchange charges.

Indian rupee travel money

Are you planning to explore the diverse landscapes and vibrant culture of India? Let’s get you ready with valuable information about India currency and card payments in India!

Where can you get Indian rupees?

You can get Indian rupees in the UK at Manor FX.

Unlike major currencies, you can’t get Indian rupees in the UK easily. You won’t find it at the post office or from banks.

Can you buy Indian rupees in the UK?

Yes. You can buy Indian rupees online from currency providers like us!

We’re the best place to buy INR rupee money. We have the best exchange rate for pounds to Indian rupee online.

Why not avoid the costly airport exchange and have your Indian currency delivered right to your door before your trip?

Experience effortless currency exchange with Manor FX, the best place to buy Indian rupees.

Enjoy a straightforward ordering process and competitive rates, ensuring you have more money for your Indian adventure when you order Indian rupees with us.

If you’re near Heathrow, you can also visit our bureau for the same outstanding Indian rupee GBP exchange rates.

Can I buy rupees before I go to India?

Absolutely, and it’s a brilliant idea! We have the best INR exchange rates, so exchange your British pound to rupees and buy Indian currency online now.

Should I exchange money before I travel to India?

Yes, exchanging some British pounds before you travel to India is a good idea.

This way, you’ll have local currency in your wallet ready for immediate expenses like transport, meals, and small purchases upon arrival.

What is the best currency to bring to India?

The Indian rupee (INR) is your best option when travelling to India. It’s the official currency and widely used.

While some major currencies are accepted in specific places, the Indian government restricts the use of foreign currencies for transactions. So, being able to use the US dollar is not guaranteed.

Using US dollars might result in less favourable exchange rates. Stick to India rupees for smooth and cost-effective travel.

The Reserve Bank of India recommends that travellers carry Indian rupee money for local purchases.

Can I use US dollars in India?

The US dollar is not widely accepted for transactions in India.

However, foreign currencies such as British pounds or US dollars can easily be exchanged for India rupees (INR) at banks, currency exchange centres, or hotels.

The Reserve Bank of India regulates all currency exchange rates, but you can save time and avoid hassle by securing your travel money in advance.

Can I use my bank card in India?

It depends. Most stores in India do not accept international card payments.

However, many international hotels, upscale boutiques, large shopping centres, and major supermarkets do. Especially in cities like Delhi and Mumbai.

India has introduced contactless payments. You can make purchases by tapping your card on the reader for amounts up to 5,000 INR. For higher amounts, you’ll still need to enter your PIN code.

If you plan to use your card in India, be mindful of currency conversion fees, the exchange rate and bank charges.

Your bank’s exchange rate from INR to GBP may not be favourable, as banks profit from this.

Contact your bank before using your card for payments in India to prevent them from blocking your card or bank account.

Should I use cash in India?

Carrying cash in India is crucial for various transactions. We strongly advise having the Indian rupee (INR) on hand during your journey.

Indian rupee cash is handy for making purchases at local stores, dealing with street vendors and covering taxi fares.

You’ll also need money for public transportation, tips, exploring markets, and dining at local eateries.

Buy Indian rupees now

Is it better to use cash or credit card in India?

Having some money with you as cash is a good idea when you’re in India. Many places in Indian cities don’t accept credit and debit cards.

Vendors such as taxi drivers, street vendors, and local tour guides often prefer cash for transactions.

Have leftover currency from your trip? Convert Indian rupees for GBP with Manor FX when you return.

How much cash should I bring to India?

India offers travellers a wide range of experiences. Your expenses will vary depending on where and when you visit.

You’ll find that bustling urban hubs like Delhi and Mumbai often have a higher price tag.

Venturing into enchanting, off-the-beaten-path locales like Jaipur or Udaipur can be a budget-friendly alternative.

Note: Prices may rise significantly during major festivals and events. Plan ahead to navigate any potential increases in accommodation and activity costs.

How can I avoid ATM fees in India?

Avoid ATM fees in India with these suggestions:

- For lower or no fees, opt for ATMs from major Indian banks like the State Bank of India, ICICI Bank, and HDFC Bank.

- Withdraw larger amounts less often to minimise the frequency of ATM visits and fees.

- Contact your home bank before your trip. Inquire about partnerships with Indian banks offering their customers free ATM usage.

- Change currency before your trip with Manor FX to avoid excessive ATM usage. We offer the best Indian rupee rates and doorstep delivery, ensuring you have Indian rupee currency on hand.

Is India cheap for tourists?

Yes! India is excellent value for travellers with mixed budgets. Here’s a brief overview:

Local food

Relish local cuisine with dishes like biryani or masala dosa. They can cost as little as 100 to 200 rupees (approximately £1-£2).

Budget-friendly transportation

Public trains and buses are budget-friendly ways to travel. Fares can be as low as 10 to 50 rupees (about £0.10 to £0.50).

Natural beauty accessible to all

Many of India’s incredible natural wonders and historic sites have low or no entrance fees.

India warmly welcomes travellers with various budgets. With some savvy planning, you can enjoy an incredible Indian adventure without exceeding your budget.

How does tipping work in India?

Tipping in India is common.

- A 10% tip is typical at restaurants, though some may include a service charge—always check the bill.

- In bars, rounding up or leaving small change is appreciated. For taxis, rounding up the fare is the norm.

- On guided tours, tipping the guide is polite, and in hotels, tips range from 100 to 500 rupees for staff services.

Is India safe for tourists?

It’s essential to exercise increased caution when considering travel to India due to civil unrest and the threat of terrorism.

India has experienced terrorist attacks in the past, targeting various public areas, including tourist locations, transportation hubs, markets, shopping malls, government facilities, hotels, and restaurants. The threat of such attacks remains a concern.

When travelling in India, stay vigilant and aware of your surroundings, especially in tourist locations and crowded public venues.

Follow the instructions of local authorities and monitor local media for updates. Be prepared to adjust your plans based on the latest information.

Buy Indian rupees now

Indian rupee currency

The Indian rupee has a rich history that reflects the country’s journey from colonial times to independence. Introduced in its current form in 1947, the rupee has evolved with the nation.

The Reserve Bank of India oversees its regulation and security, ensuring it remains stable and secure.

The India rupee replaced all the currencies used by previously autonomous states and is now the only legal tender.

Indian banknotes

India rupee banknotes come in different denominations. They showcase notable figures from the country’s history, scenic landscapes, and cultural icons.

You’ll commonly find 10, 20, 50, 100, 500, and 2,000 Indian rupee notes in circulation. Take care not to accept counterfeit banknotes.

Indian rupee coins

Indian coins come in various denominations, ranging from 1 rupee to 10 rupees. They are an essential part of the currency system in India.

Each coin features national symbols, such as the Ashoka Pillar or the Rupee symbol (₹), on one side. The other side indicates the denomination and year of minting.

It’s crucial to verify the authenticity of coins when handling them, as counterfeit coins occasionally circulate.

Additionally, damaged or defaced coins may not be accepted in transactions, so checking their condition is wise.

The new paise, introduced in 1957 during the decimalisation of the Indian rupee, is now rarely used in daily transactions. However, it remains a significant part of India’s monetary history.

Indian currency import and export regulations

Import of Indian currency:

- Travellers can import up to 25,000 Indian rupees (INR) per person when entering India. This means you can carry up to 25,000 INR in cash when you arrive in India.

- There are no specific limits on the amount of foreign currency you can bring into India. However, if you carry foreign currency equivalent to or exceeding $10,000 (or its equivalent in other foreign currencies), you must declare it to Indian customs authorities upon arrival.

Export of Indian currency:

- Indian rupees (INR) cannot be exported from India to foreign countries. This means you cannot take Indian rupees out of India when you leave the country.

Export of foreign currency:

- When you leave India, you can carry foreign currency notes and coins up to the amount you declared when you arrived. Any foreign currency over this amount should be declared to Indian customs authorities.

- Retaining exchange receipts or other documentation for foreign currency exchange transactions is essential during your stay in India. This documentation may be required to prove the source of your foreign currency when leaving the country.

Be aware that you cannot import or export Indian and Pakistani currencies.

Ordering Indian rupees online

Exchange pounds to Indian rupees currency today through Manor FX. Buy Indian rupees and get them delivered swiftly and securely to your home or office with Royal Mail Special Delivery Guaranteed®.

You can also buy INR or pick up your India rupees from our Manor FX travel money shop near Heathrow. Click here to convert GBP into INR now.

Selling back Indian rupees

Need to turn your Indian rupees to pound sterling? Simply use this link to convert Indian rupees to pounds. Click on the ‘sell currency’ option and specify ‘Indian rupee (INR)’.

Manor FX offers the best Indian rupee GPB exchange rate for your unused Indian rupee money. Ensure you get the most value from your Indian rupee currency exchange.

FAQs

How many Indian rupees to a pound?

As of 19th September 2024, 1 British pound (GBP) is equivalent to approximately 111.13 Indian Rupees (INR).

Keep in mind that exchange rates can fluctuate. Checking the current rate before exchanging currency is always a good idea.

Do you need a visa to go to India?

Yes, India offers various types of visas, including tourist visas, business visas, and more. Depending on your travel purpose and stay duration, it is essential to apply for the appropriate visa.

You can apply for an Indian visa through the official website of the Indian Visa Application Centre (VFS Global). You can also visit the nearest Indian embassy or consulate.

Check the specific visa requirements and application procedures before planning your trip to India.

What vaccinations are required for India?

There are no specific vaccinations required for entry into India. However, it’s highly recommended that travellers to India consult with a doctor or travel medicine specialist.

This is to determine the appropriate vaccinations based on your health, travel plans, and the regions you intend to visit.

Commonly advised vaccinations for travellers to India include hepatitis A, typhoid, and, depending on the circumstances, hepatitis B, polio, and Japanese encephalitis.

Also, precautions against diseases like malaria and travellers’ diarrhoea are essential.

What is the best time to travel to India?

The best time to visit India varies by region and weather preferences.

Generally, the peak tourist season is from October to March when the weather is cool and pleasant. Ideal for exploring destinations like Delhi, Agra, Rajasthan, Kerala, and Goa.

Northern hill stations like Shimla and Manali can be cold, so pack accordingly.

Summer (April to June) is extremely hot in the north, but hill stations and southern regions are more bearable.

Monsoons (June to September) bring heavy rains, making travel challenging, but Kerala and Goa are lush and less crowded.

Shoulder seasons (October-November and February-March) offer fewer crowds and good weather.

Feel the Trustpilot love

Great competitive rates & friendly & helpful staff. Easy to order online & collect in person or delivery.

Great, fast and reliable service would certainly use again for my travel needs, as the rates are the best around!

This amazing company have gone above and beyond in getting a large amount of a rare currency across the pond to Ireland.

Great rates and really responsive, friendly customer support, will definitely be using Manor FX again.

Manor FX gave me a better rate than my bank with great customer service, I highly recommend them.

Family run business that’s always super helpful. Manor FX’s rates are always really good as well!

Get

Get

Indian Rupees Fast!

- Free home delivery over £750

- with Royal Mail Special Delivery 1pm

- Better rates than the banks